Life insurance quotes help you understand how much premium you need to pay for a policy. These quotes change based on your age, health, lifestyle, policy type, and coverage amount. In this guide, you will learn how life insurance quotes work, how to compare them online, and how to get the best premium in 2026.

This pillar page connects you to all supporting articles such as age-based quotes, no-medical quotes, smokers’ quotes, whole life insurance quotes, calculators, and comparison guides.

Let’s begin.

🔹 What Are Life Insurance Quotes?

A life insurance quote is the estimated premium you must pay to get a specific life insurance coverage.

It is based on:

- Age

- Sum assured

- Policy type

- Health condition

- Lifestyle (smoker or non-smoker)

- Profession

- Add-on riders

Life insurance quotes help you compare different plans before making a decision. They also help you understand how much coverage you can afford.

👉 For a detailed breakdown, read: How Are Life Insurance Quotes Calculated in India?

🔹 How Life Insurance Premium Is Calculated

Insurance companies follow a simple formula:

Higher risk = Higher premium

Lower risk = Lower premium

Factors that increase premium:

- Older age

- Smoking

- Drinking

- Pre-existing health issues

- High-risk jobs

- Large sum assured

- Long coverage duration

- Critical illness riders

For a complete breakdown, see: Why Life Insurance Quotes Increase With Age

🔹 How to Get Life Insurance Quotes Online in India

Getting online quotes is simple and fast. Follow these steps:

- Enter your age and date of birth

- Select your coverage amount (₹10L, ₹20L, ₹50L, ₹1 Crore, etc.)

- Choose your policy type (Term, Whole Life, ROP)

- Mention smoking status

- Add riders if required

- Compare premium from different companies

- Choose the best plan and get instant quote

For detailed steps, visit: How to Compare Life Insurance Quotes Online

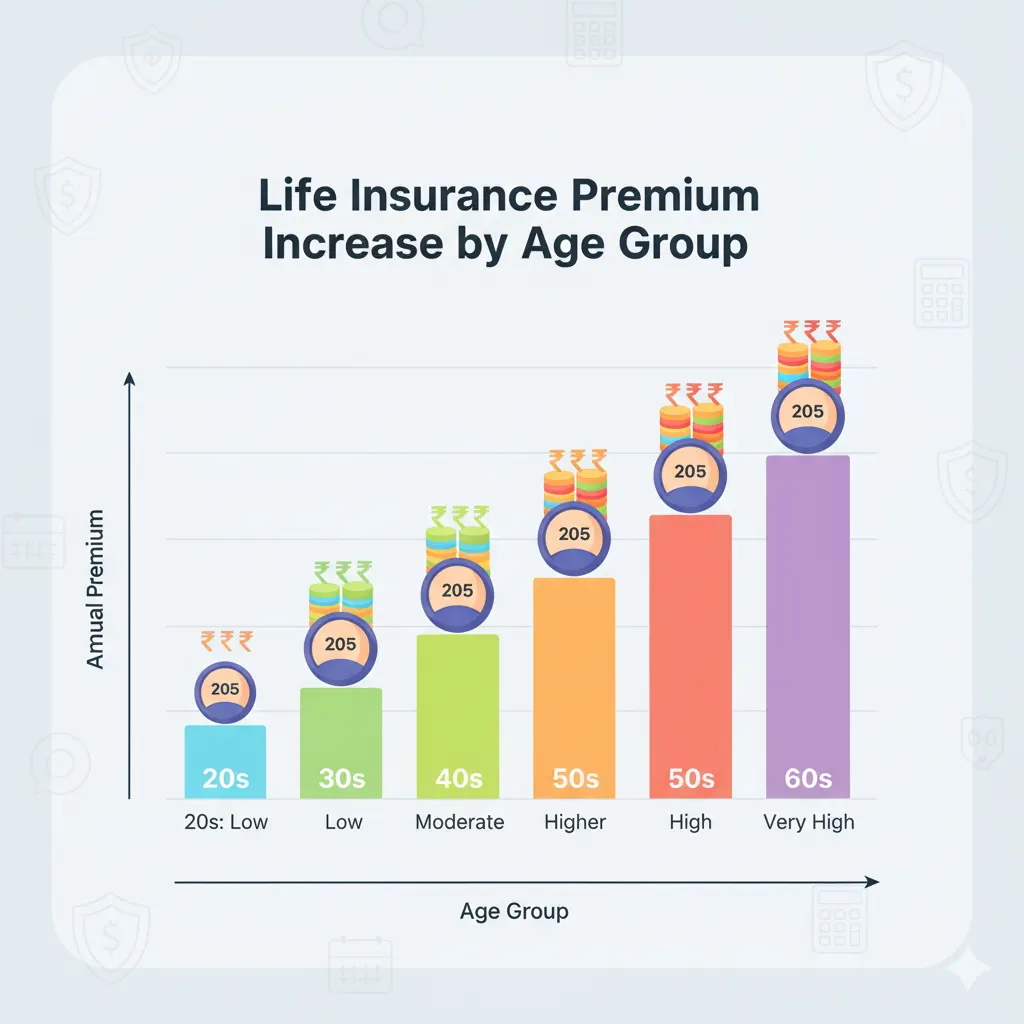

🔹 Life Insurance Quotes by Age (Age-Based Quotes)

Age is the most important factor affecting life insurance premium. The younger you are, the lower your premium.

Here are detailed age-based quote guides:

- Life Insurance Quotes for Seniors

- Life Insurance Quotes for Kids

- Life Insurance Quotes for Over 70

- Life Insurance Quotes for Over 50

Example of how age affects premium (₹50 lakh cover, non-smoker):

| Age | Monthly Premium |

|---|---|

| 25 | ₹450–₹550 |

| 30 | ₹550–₹650 |

| 40 | ₹900–₹1200 |

| 50 | ₹1800–₹2500 |

| 60 | ₹3500–₹6000 |

Premium increases sharply after age 40, and it becomes very high after age 50.

🔹 Life Insurance Quotes by Policy Type (Policy-Based Quotes)

Different policy types generate different premium ranges. Here are the most important policy types:

1. Term Life Insurance Quotes

Term insurance offers high coverage at a low premium.

👉 Read: Term Life Insurance Quotes Online India

2. Whole Life Insurance Quotes

Covers you for your entire life.

👉 Read: Whole Life Insurance Quotes India

3. Return of Premium (ROP) Quotes

Premium returns if you survive the policy term.

👉 Read: Return of Premium Life Insurance Quotes

Each policy type is suitable for different needs. Term plan is cheapest, ROP is costlier, and whole life insurance is the costliest.

🔹 Life Insurance Quotes Based on Conditions

Your health and lifestyle directly impact premium.

1. No-Medical Test Quotes

Suitable for:

- Younger buyers

- People who want quick approval

- Small cover amounts

👉 Read: Life Insurance Quotes Without Medical Test India

2. Instant Life Insurance Quotes

Instant quotes are offered online for quick policies.

👉 Read: Instant Life Insurance Quotes Online

3. Quotes for Smokers

Smokers pay 30%–70% higher premium.

👉 Read: Life Insurance Quotes for Smokers India

🔹 Comparison Articles (High-Intent Pages)

Comparison pages help you choose the best insurer.

1. LIC vs Private Companies Quotes

LIC is stable and reputed, but private companies offer lower premiums.

👉 Read: LIC Life Insurance Quotes vs Private Companies

2. Term Insurance vs Whole Life Insurance Quotes

Term plans = low premium

Whole life = lifetime coverage

👉 Read: Term Insurance Quotes vs Whole Life Insurance Quotes

3. Best Life Insurance Quotes in India 2026

Top companies include:

- LIC

- HDFC Life

- ICICI Prudential

- SBI Life

- Max Life

👉 Read: Best Life Insurance Quotes in India 2026

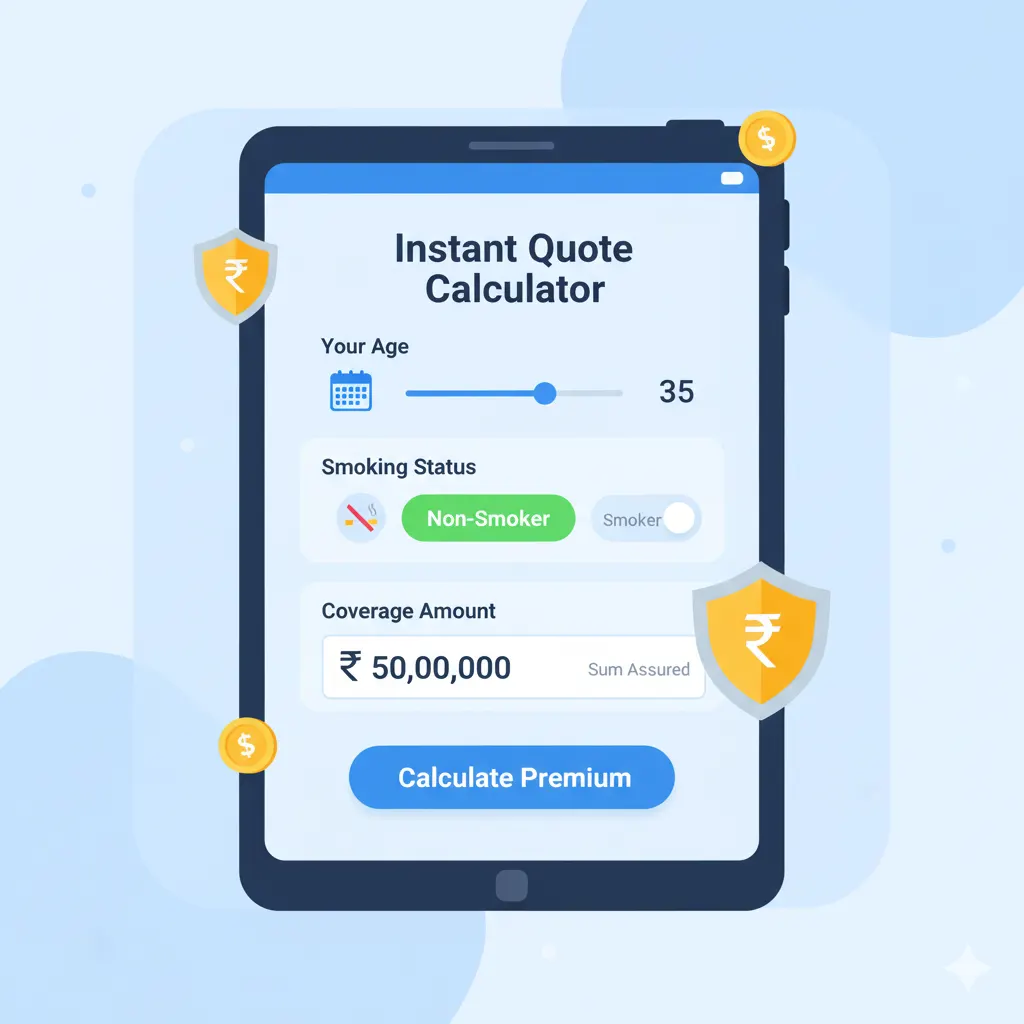

🔹 Life Insurance Quote Calculators

Calculators help you get precise premiums.

1. Life Insurance Quotes Calculator

Shows premium based on:

- Age

- Policy type

- Smoking status

👉 Read: Life Insurance Quotes Calculator – How Premium is Calculated

2. Term Insurance Premium Quotes Calculator

Shows premium for ₹50L, ₹1 Cr, and other amounts.

👉 Read: Term Insurance Premium Quotes Calculator

🔹 Guides to Improve Your Knowledge (Authority Signals)

These articles help users make informed decisions.

✔ How Are Life Insurance Quotes Calculated in India?

✔ Why Life Insurance Quotes Increase With Age

✔ How to Get the Cheapest Life Insurance Quotes in India

✔ Mistakes to Avoid When Buying Life Insurance

Link all these to build deeper topical authority.

🔹 Sample Life Insurance Quote Chart (For 2026)

| Age | Coverage | Smoker | Monthly Premium |

|---|---|---|---|

| 25 | ₹50 lakh | No | ₹450–₹550 |

| 30 | ₹1 crore | No | ₹750–₹900 |

| 40 | ₹50 lakh | Yes | ₹1500–₹1900 |

| 50 | ₹50 lakh | No | ₹1800–₹2500 |

| 60 | ₹25 lakh | Yes | ₹3500–₹6000 |

Note: These are approximate values.

🔹 FAQs About Life Insurance Quotes

1. Are online quotes accurate?

Yes, they are usually close to the final premium.

2. Why do premiums increase with age?

Older age = higher risk = higher premium.

3. Which is the cheapest life insurance plan?

Term life insurance.

4. Do smokers pay higher premiums?

Yes, smoking increases premium by 30%–70%.

5. How much coverage do I need?

Ideally 10–15 times your annual income.

🔹 Conclusion

Life insurance quotes help you understand how much premium you will pay for the coverage you choose. By comparing quotes based on age, health, policy type, and company, you can get the best plan in 2026.

Explore the detailed guides linked above to find the right plan for your needs. These supporting articles will help you choose the best insurer, calculate premium accurately, and avoid common mistakes.